PH BIR 2118-EA 2021-2026 free printable template

Show details

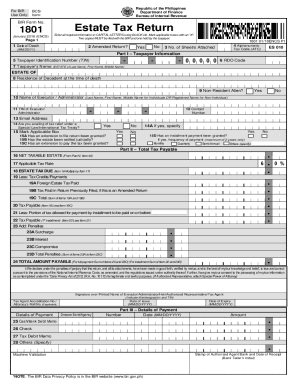

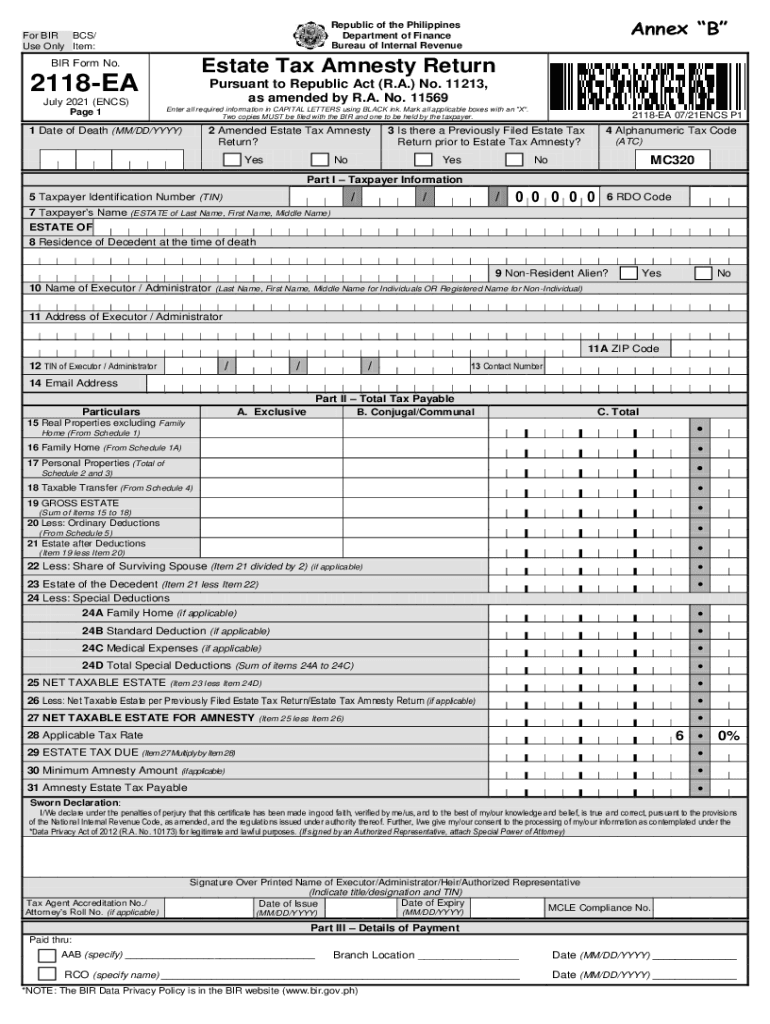

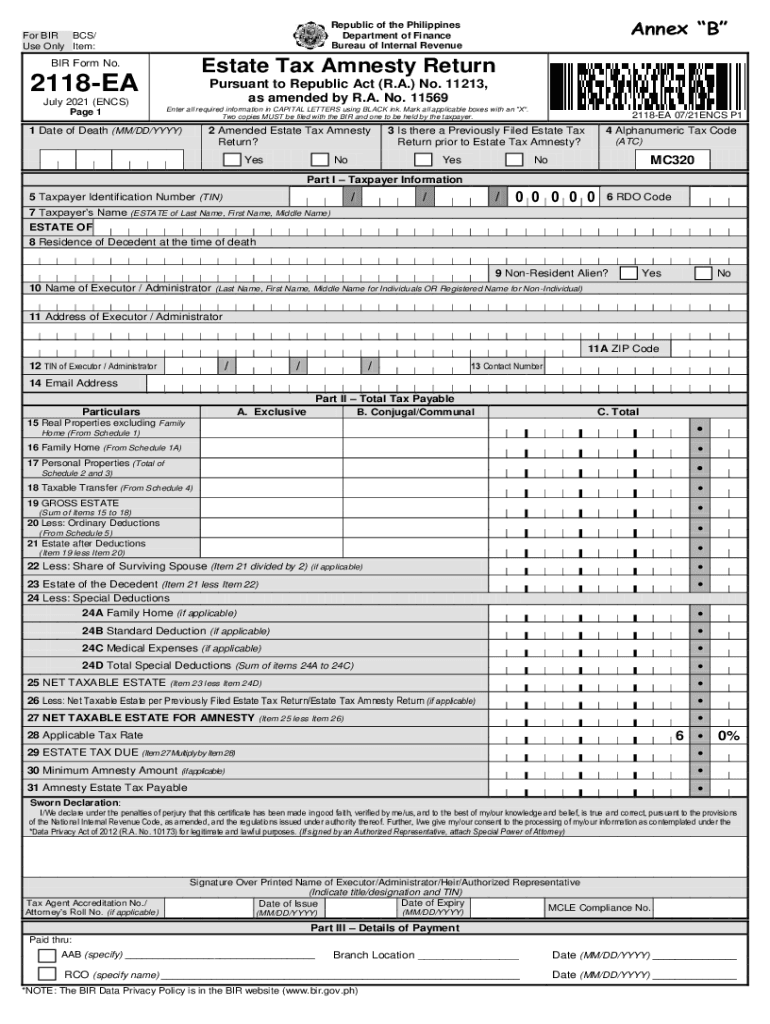

This form is used to declare estate tax amnesty as per Republic Act No. 11213 and its amendments. It requires the taxpayer to provide necessary information about the decedent's estate and the applicable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate tax form 2025

Edit your ph bir 2118 ea is from sources other than compensation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir estate tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit obtain a copy of the or your local bir office text fill in the taxpayer identification online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2118 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH BIR 2118-EA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 2118

How to fill out PH BIR 2118-EA

01

Obtain a copy of the PH BIR 2118-EA form from the Bureau of Internal Revenue (BIR) website or your local BIR office.

02

Fill in the Taxpayer Identification Number (TIN) in the designated field.

03

Provide your name, address, and contact information accurately.

04

Indicate the type of income earned for the year (e.g., compensation, business income, etc.).

05

Calculate your total income and any allowable deductions.

06

Determine your tax due based on the relevant tax rates.

07

Fill in the amount of tax payments previously made or any tax credits applicable.

08

Sign and date the form certifying the accuracy of the information provided.

09

Submit the completed form to the appropriate BIR office before the deadline.

Who needs PH BIR 2118-EA?

01

Individuals who earn income in the Philippines, including self-employed persons, professionals, and business owners, who need to report their annual income and pay their taxes.

Fill

estate tax return form

: Try Risk Free

People Also Ask about amnesty form

How much can you inherit from your parents without paying taxes?

The federal estate tax exemption shields $12.06 million from tax as of 2022 (rising to $12.92 million in 2023). 2 There's no income tax on inheritances.

What is amnesty tax Philippines 2022?

The Bureau of Internal Revenue (BIR) has announced that they will provide an extension for estate tax amnesty in the Philippines. It means taxpayers who have yet to settle their estate taxes will have more time to do so. The extension period will run from August 15, 2021, until June 14, 2023.

How do I get a certificate of tax exemption from BIR?

Fill-up the BIR Form No. 1701 in triplicate copies. Proceed to the Revenue District Office where you are registered or to any Tax Filing Center established by the BIR and present the duly accomplished BIR Form 1701, together with the required attachments.

How can I avoid inheritance tax in the Philippines?

In the Philippines, a graduated tax rate determines inheritance taxes. Estates with a net value of less than Php 200,000 are exempted from paying inheritance tax while those valued at a higher amount may be required to pay a tax rate of anywhere from 5% up to 20%.

Can you go to jail for not paying taxes in Philippines?

- Any person who carries on any business for which a private tax is imposed without paying the tax as required by law shall, upon conviction for each act or omission, be fined not less than Five thousand pesos but not more than Twenty thousand pesos and suffer imprisonment of not less than six months but not more than

How much can you inherit without paying taxes in 2022?

For 2022, the federal estate exemption is $12.06 million, and it will increase to $12.92 million in 2023. Estates smaller than this amount are not subject to federal taxes, though individual states have their own rules. Internal Revenue Service.

How much is the amnesty tax in the Philippines?

60% of the computed basic tax liabilities as shown in the criminal complaint filed by the BIR with the DOJ/Prosecutor's Office or in the information filed in the Courts for violations of tax laws and regulations. 50% of the basic tax liabilities as per the Court's final and executory decision.

What is a good reason for penalty waiver?

You may qualify for penalty relief if you demonstrate that you exercised ordinary care and prudence and were nevertheless unable to file your return or pay your taxes on time. Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances.

How much is estate tax amnesty?

Note that the amnesty tax rate of 6 percent is set on the net estate of the decedent. In determining the net estate, there are allowable deductions against the value of the gross estate of the decedent at the time of death.

How do wealthy families avoid inheritance tax?

Put assets into a trust If you place assets within a trust they will not form part of your estate on death and avoid inheritance tax. You could place assets into a trust for the benefit of your children when they reach the age of 18 for example.

How can I get tax exemption certificate from Bir Philippines?

Fill-up the BIR Form No. 1702Q in triplicate copies. Proceed to the Revenue District Office where you are registered or to any Tax Filing Center established by the BIR and present the duly accomplished BIR Form 1702Q, together with the required attachments.

How is estate tax calculated in amnesty Philippines?

The estate amnesty tax rate is 6 percent, imposed on the decedent's total net taxable estate at the time of death without penalties at every stage of transfer of property. Note that the minimum estate amnesty tax for each decedent shall be P5,000.

How do I get income tax exemption?

Tax exemptions can be availed by investing in the following tools: Senior Citizen Savings Scheme (SCSS) Sukanya Samriddhi Yojana (SSY) National Pension Scheme (NPS) Public Provident Fund (PPF) National Pension Scheme (NPS)

How do I get my tax penalty waived?

Write a letter to the IRS requesting a penalty waiver. State the reason you weren't able to pay, and provide copies—never the originals—of the documents you're offering as evidence. You should mail the letter to the same IRS address that notifies you about your penalty charges.

How do I disregard BIR penalties?

Tips to Legally Avoid Paying BIR Penalties During Tax Mapping BIR Certificate of Registration (BIR Form 2303) Annual Registration Fee for the Current Year (BIR Form 0605) Notice to the Public “ASK FOR RECEIPT” Signage.

How much is the penalty for late filing of ITR Philippines?

Section 255 also imposes a compromise penalty of not less than P10,000 and imprisonment of not less than 1 year but not more than 10 years for willfully neglecting to file tax returns.

How much tax do I pay on an inheritance in the Philippines?

There is no inheritance tax in the Philippines. However, an estate tax of 6% is imposed on the assets of the decedent taxpayer.

What is an exemption certificate?

an official document that gives someone special permission not to do or pay something: a medical/tax exemption certificate.

How do I pass an inheritance without paying taxes?

8 ways to avoid inheritance tax Start giving gifts now. Write a will. Use the alternate valuation date. Put everything into a trust. Take out a life insurance policy. Set up a family limited partnership. Move to a state that doesn't have an estate or inheritance tax. Donate to charity.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 211 revised 2025 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including estate tax return sample, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit bir form for estate tax in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing bir amnesty and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out the ecar bir sample 2025 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign bir form 2303 sample philippines on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is PH BIR 2118-EA?

PH BIR 2118-EA is a tax form utilized in the Philippines for the annual income tax return for individuals and businesses who earn income from sources other than compensation.

Who is required to file PH BIR 2118-EA?

Individuals and entities such as self-employed professionals, freelancers, and business owners who earn income outside of regular employment are required to file PH BIR 2118-EA.

How to fill out PH BIR 2118-EA?

To fill out PH BIR 2118-EA, taxpayers must provide personal information, details of income earned during the year, deductions, and other relevant financial data. It is advisable to refer to the official guidelines or consult with a tax professional for accurate completion.

What is the purpose of PH BIR 2118-EA?

The purpose of PH BIR 2118-EA is to report annual income and determine the tax liability of individuals and entities who do not receive compensation from employers, ensuring they comply with Philippine tax laws.

What information must be reported on PH BIR 2118-EA?

The information that must be reported on PH BIR 2118-EA includes personal identification data, gross income, allowable expenses and deductions, tax credits, and the resulting taxable income to calculate the final tax due.

Fill out your PH BIR 2118-EA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Immigration Form is not the form you're looking for?Search for another form here.

Keywords relevant to estate tax return

Related to ecar bir form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.